|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

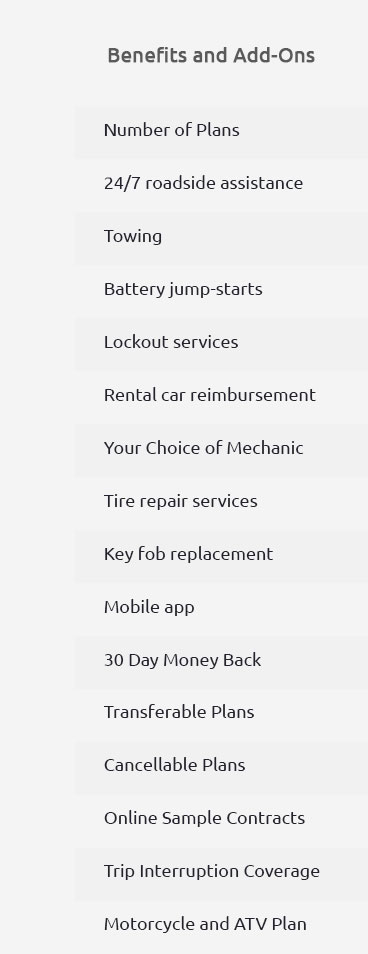

Auto Protection Policy: Comprehensive Coverage GuideExploring an auto protection policy can be a daunting task for U.S. consumers. With vehicle repair costs on the rise, understanding your options for extended auto warranties is crucial. This guide aims to provide peace of mind by breaking down the benefits, coverage options, and common concerns associated with these policies. Understanding Auto Protection PoliciesAuto protection policies, often referred to as extended auto warranties, offer coverage for repairs and parts replacements beyond the manufacturer's warranty. This can be a lifesaver when unexpected issues arise. Benefits of Auto ProtectionPeace of Mind: Knowing that major repair costs are covered helps reduce stress and financial strain. Cost Savings: Extended warranties can save you thousands of dollars in repair costs over the lifetime of your vehicle. What's Typically Covered?

While these are common areas covered, always review the specific policy details before committing. Making Informed DecisionsWhen considering an auto protection policy, it's essential to evaluate your driving habits, vehicle age, and reliability. For those driving in urban areas like New York City, where stop-and-go traffic can wear down parts quickly, an extended warranty might be particularly beneficial. To better understand your financing options, visit car repair payment options for detailed insights. Frequently Asked QuestionsWhat is an auto protection policy?An auto protection policy is an extended warranty that covers certain repair costs after the manufacturer's warranty expires. How does an auto protection policy save money?By covering major repair costs, an auto protection policy can prevent large, unexpected expenses, offering significant savings over time. Is purchasing an extended warranty necessary?While not necessary, an extended warranty can provide additional coverage and peace of mind, especially for those with older vehicles or those driving extensively. Choosing the Right PolicySelecting the right auto protection policy depends on your vehicle's make, model, and your personal driving needs. For instance, if you own a Nissan, you might want to purchase Nissan extended warranty for tailored coverage options. In summary, an auto protection policy can be a smart investment for those looking to safeguard against high repair costs. By understanding what is covered and the potential savings, you can make an informed decision that suits your needs. Whether you're driving through the bustling streets of Los Angeles or the open roads of Texas, a comprehensive policy offers security and confidence in your journey. https://novawarranty.com/what-exactly-is-a-vehicle-protection-plan/

A car protection plan, also known as a vehicle service contract or extended warranty, is a contract that provides financial protection to ... https://www.directauto.com/our-products/emergency-protection

See how an Emergency Protection Plan from Direct Auto can help pay for the unexpected expenses of an auto accident. Call 1-877-463-4732 to learn more! https://www.zurichna.com/industries/auto/owners/vehicle-protection

While a manufacturer's warranty can protect you against certain breakdowns, true peace of mind comes from knowing you're ...

|